Everything You Need to Know to Fill Out the FAFSA in 2022

8 Easy Steps to Filling Out the FAFSA

One of the most daunting parts of any college education is filling out the dreaded FAFSA. If you think I’m kidding, just ask any parent who has had to complete the FAFSA before the Data Retrieval Tool became available, or better yet, before it was electronic. You are likely to find someone who shudders involuntarily at the thought.

Thankfully, we now have the miracle of the Data Retrieval Tool (DRT), which makes those who use it jump for joy, especially if they had filled out a FAFSA in the dark ages before the DRT was a thing.

Even with the technological advances, I still have many clients who worry about filling out the FAFSA. I chalk this up to fear of the unknown and the many many rumors that have lingered since the days pre-DRT.

The focus of this post is to give you some insights into the FAFSA that aren’t readily available in other places on the web, to reduce some of the concern that people feel over filling out the FAFSA, and to get some insightful questions answered by a well-versed Financial Aid professional. So, I’ve interviewed Mr. Jared Menghini, Interim Vice President for Enrollment and Financial Aid at Wilkes University. With his impressive title comes a vast wealth of knowledge on the FAFSA and Financial Aid processes and he has graciously agreed to share some of that with us.

Me: How would you describe the FAFSA to someone who is unfamiliar with it?

JM: The FAFSA is a complex application that, if taken step-by-step, can be filled out fairly easily by families. One of the tools that the FAFSA has integrated to make filing easier is the IRS Data Retrieval Tool (DRT). The DRT allows the FAFSA to connect directly to the IRS system and keeps you from having to input your tax information, as it pulls all of your most recent tax information and inserts it into the appropriate areas of the FAFSA. This saves families a lot of time when filling out the FAFSA.

Me: What should parents/students know about the FAFSA to make it easier to fill out or to maximize the funding they receive?

JM: To make filling out the FAFSA easier, make sure to get your FSA ID early, especially for families who have a common last name. Keep the FSA ID someplace safe, where you won’t lose it. You can get this at any point, even tomorrow, so you have it an advance

To Maximize your Financial aid award package, sit down with the financial administrators for your top 2 or 3 (not more than 3) institutions to get questions answered and to see if there is an institutional scholarship or other form of aid that isn’t widely publicized that you may be eligible for. Many schools are coming out with their strongest packages upfront and knowing that they are in your top 2 or 3 schools may incentivize them to see if there is anything extra they can offer you.

Me: Are there going to be any new updates to the FAFSA for the 2022-2023 application?

JM: The FAFSA no longer requires you to answer the question about selective service registration or felony/misdemeanor charges. By doing this, the Department of Education is helping incarcerated students by granting them eligibility for Pell Grants to allow them to graduate with Bachelors while in prison or shortly after release.

This year they will also provide more aid for independent upperclassmen.

They are also attempting to maximize use of previously collected data. There has been a push to make it more user friendly, especially as the years progress and we move towards the roll out of the new Student Aid Index.

Me: What is the Student Aid Index?

JM: It is essentially a redesign for the FAFSA that is scheduled to come out 2024-2025. It will still collect all of the relevant financial data, much of what is collected now, but it will be more user-friendly and should have more students qualify for Pell Grants.

Me: What are the important dates for students and parents to be aware of?

JM: It’s important for families to be aware of when the FAFSA opens and what date(s) their institutions recommend having the FAFSA completed by. In my mind, the important dates are:

Oct 1st- New FAFSA goes live

Jan 1st- Everything completed by (depending on the school, this may be sooner)

New Year- Start receiving financial aid offers

Me: Are there any professional tips or tricks to filling out the FAFSA that are helpful to know?

JM: The FAFSA pulls all of your financial data, even the current balance of your bank accounts. The more you have in savings, the more the FAFSA believes you are able to pay for education. So, if you have money earmarked in a bank account for a specific project (like putting a new roof on your house), it would be wise to do that project prior to filling out the FAFSA.

Also, if there are any monetary gifts in large amounts for college funding (from grandparents or other family members), it is best to put it in the parents name or keep it in grandparents’ account.

Me: Do you recommend that families hire a service to fill out the FAFSA or fill it out on their own?

JM: Typically, I don’t recommend paying for a service. Many colleges and universities offer workshops to guide families through the FAFSA application process. You can find a local college who is offering a FAFSA workshop and attend it, regardless of whether you plan to apply to that institution. Something else to keep in mind is that an accountant views the FAFSA from an assets perspective and may add assets that aren’t required that will do a disservice to the family.

Me: What common misconceptions do you hear most about the FAFSA that you’d like to debunk?

JM: The biggest one that I hear is that most families think they won’t get anything so it’s not worth filling out the FAFSA. The FAFSA also qualifies you for state funding and possibly other college level funding, so in my opinion, it is always worth filling it out. Even if you don’t qualify for any grants, you will still likely be eligible for subsidized loans, which helps students build credit while in school. Making payments on unsubsidized loans (typically small amounts) builds credit even faster.

Me: Can you give us some insights into how the FAFSA process works (the behind-the-scenes stuff that families don’t see or may not know about)?

JM: From my side, it pulls in all of the parent information and breaks it down, based on income, untaxed income, pension plans, etc. We see the same information for students. The Estimated Family Contribution (EFC) is a two part calculation. It has the parent EFC and student EFC which gives the overall EFC which is used to determine federal and state aid.

Me: As someone who reviews FAFSA information, how can families avoid being selected for verification and needing to provide more documentation?

JM: Being selected for verification doesn’t mean that a family did something wrong while filling out the FAFSA. The Department of Education selects a specific population (for example, families with 5 dependents) each year to be verified. Using the Data Retrieval Tool helps if you are selected for verification as it allows automatic transfer of data between the IRS and the FAFSA and cuts down on the information you need to provide.

Me: Lastly, is there anything that I haven’t covered that you’d like to share with parents and students as they start to think about filling out the FAFSA this fall that I haven’t already asked?

JM: There are a few things I think families and students should know. First, I believe that families should do more research on the FAFSA. The paper application is still available for you to review so you can read and understand the instructions. The paper application gives you more information about what the FAFSA is looking for to answer each question. You can print out the paper FAFSA so you can have it handy when you fill out the online version.

Also, on studentaid.gov you can do an estimate that is about 5-10 minutes. It will give you a general idea of what you are looking at for Estimated Family Contribution (EFC).

Even with a background in admissions and a strong understanding of the FAFSA and financial aid, I personally still have a few good take-aways from this. A huge thank you to Mr. Menghini for sharing his knowledge with us.

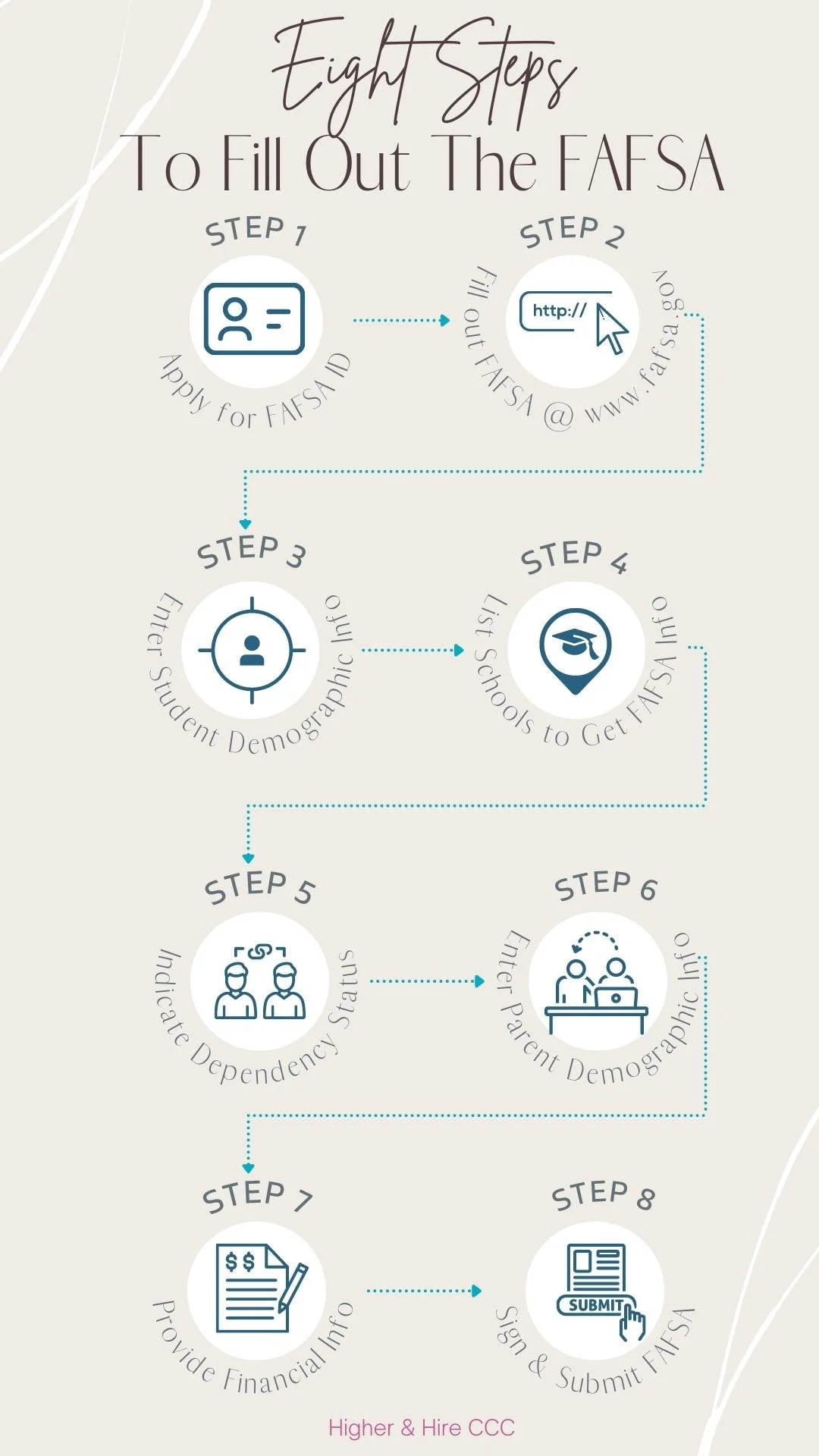

For those of you who still need some direction, I’m including my simple 8 Step Guide to Filling Out the FAFSA below.

Step 1: Apply for FAFSA ID

Step 2: Fill out the FAFSA at www.fafsa.gov

Step 3: Enter student demographic information

Step 4: List schools to get your FAFSA information

Step 5: Indicate Dependency Status

Step 6: Enter parent demographic information

Step 7: Provide financial information

Step 8: Sign and submit FAFSA

I hope you’ve found this helpful (and find some time to color in your future). If you are looking for more information, please visit my website- Higher & Hire. If I can be of assistance to you, please reach out to me here.

Many Thanks!

Valerie Palmer - Career and College Admissions Expert